Less than 24 hours after Trayvon Martin was shot and killed in Florida as he returned home with a bag of Skittles, then-President Barack Obama addressed a rattled nation. Standing among a group of Chicago-area teens, he announced the launch of My Brother’s Keeper, an initiative to address the persistent opportunity gaps faced by boys and young men of color, and to ensure all young people can reach their full potential.

“I firmly believe that every child deserves the same chances that I had,” said Obama from a podium in the White House’s East Room. “That’s why we’re here today. To do what we can, in this year of action, to give more young Americans the support they need to make good choices and be resilient, and to overcome obstacles and achieve their dreams.”

Martin’s death became a catalyst for a national reckoning against structural racism, prompting many cities to respond with efforts to uplift communities of color. Some have shown signs of success; others have fallen short. But ten years after its launch, My Brother’s Keeper, now known as the MBK Alliance, has seen remarkable progress in three cities in particular, helping them prove that the power of collaboration can solve deeply entrenched problems that have plagued America for decades.

Crushed by negative news?

Sign up for the Reasons to be Cheerful newsletter.Serving as a financial and advisory resource, MBK Alliance helps foster collaborations between cities to achieve progress across six milestones identified as keys to young people’s future success: early childhood education, reading at grade level by the end of third grade, graduating from high school, completing a post-secondary education or training, getting a job and staying safe from violence.

Backed by the power of the nationwide collective, three “Model Communities” have emerged as standouts in achieving these goals: Newark, New Jersey; Omaha, Nebraska; and Tulsa, Oklahoma. Here’s a glimpse into how they did it.

Newark

Eleven years ago, Newark, with 112 homicides, had the third highest murder rate in the nation, as gun violence wracked the city’s most disadvantaged neighborhoods.

By last year that number had plummeted to 47, the lowest number of homicides in 60 years, and continuing a trend of sharply falling violent crime rates in New Jersey’s biggest city. The year prior, in 2022, Newark saw fewer homicides than it had since 1961. And two years before that, in 2020, not a single shot was fired by a police officer in Newark all year.

“The larger ecosystem in Newark working to improve public safety came together and got to work,” explains Mark Comesañas, executive director of My Brother’s Keeper Newark, which functions as an initiative of the Newark Opportunity Youth Network.

The fruits of that labor came during a crucial time, as the impact of the Covid-19 pandemic and George Floyd protests collided to shine a light on the nation’s inequities.

Mayor Ras Baraka, a son of the city, reappropriated five percent of the police budget to fund violence prevention work. Newark launched a new Office of Violence Prevention and Trauma Recovery, which uses data analysis, anti-racism and hate crime units, victim support, partnerships between police and social workers, and other proven public health approaches to increase safety. And the Newark Community Street Team, which deploys outreach workers and high-risk interventionists to mediate disputes and stop bloodshed, now works with youth most at-risk to perpetrate or become a victim of violence.

“Newark is no longer on the ‘top 10 most violent city list,’ where it had a coveted position for almost 50 consecutive years,” Street Team founder Aqeela Sherrills recently told Yahoo! News.

Most importantly, says Comesañas, also born and raised in Newark, young people, often left out of discussions aimed at understanding their challenges, now sat at the table, participating in public forums on crime and meeting with elected officials. Their success has influenced advocates to reach back further to engage youth as young as 13, he adds.

“Young people are our community’s greatest untapped resource,” he said. “Instead of seeing them as a problem to be solved we saw them as an asset in solving those problems.”

Being an MBK Alliance Model Community has allowed Comesañas and others from Newark to share their experiences, while also learning from the wins and losses of other cities, he says. For instance, his organization gleaned lessons from New York’s Young Men’s Initiative and NYC Men Teach, and an action guide from Sacramento that helped to fine tune efforts in Newark.

Still, Comesañas knows the work is not done.

“Our next phase is to ensure there’s even greater integration across all systems,” he says. “We need City Hall, community orgs and charter schools all working together and having conversations; we need to hear from more young people.”

Tulsa

Being named a My Brother’s Keeper Model Community in 2023 didn’t turn the community in Tulsa, Oklahoma, complacent. It inspired them to do more.

“We’ve activated nearly 100 more partners since becoming a Model Community, working to understand experiences of Black young men and boys of color through the milestones,” said Ashley Philippsen, executive director of Impact Tulsa, which leads local MBK efforts.

Tulsa earned its Model Community status for the strides it made towards the first predictor of success identified by My Brother’s Keeper: early childhood education.

Oklahoma began offering universal preschool education in 1998, yet several years ago thousands of children in Tulsa County, including more than 1,000 in the City of Tulsa, were not enrolled, Philippsen says. Changing that required the convening of residents, community organizations, city and county departments, businesses, and the school district, among others.

“Together, we had to shift the narrative around preschool education,” Philippsen says.

Clergy, daycare teachers, parents and schools formed teams and went door-to-door, armed with data they had collected to better understand the factors keeping kids out of preschool. “We used data as a flashlight to help our partners identify and remove roadblocks for young people in underserved communities,” Philippsen says.

They paired this face-to-face persuasion with a mass media campaign that purchased space on billboards and aired commercials on television. Churches and others preached a new awareness about the benefits of early education, while also addressing barriers to enrollment, such as a lack of programs in underserved neighborhoods.

To better understand the complex challenges of students in Tulsa, the Tulsa Child Equity Index, a project of Impact Tulsa and Tulsa Public Schools, was created in 2018 to pinpoint areas of need. The index includes data on 14 different neighborhood indicators, including gun violence, employment rate, walkability, educational attainment and socioeconomic status. Each helps to identify structural and systemic barriers, intersections between opportunity and access, Philippsen explained.

“It helps to build a deeper understanding of the factors that impact students in certain neighborhoods,” she said.

As a result of these efforts, enrollment in early childhood programs in Tulsa increased from 65 percent of eligible students in 2013 to 82 percent in 2020, and attendance overall for students of color rose by 33 percent. And while some of those gains were lost amid the pandemic, the benefits of involvement with My Brother’s Keeper, particularly as a model community, continue.

“It’s really been powerful to be part of this national network, learn from each other and share best practices so that other cities can experience the same successes,” Philippsen says.

Omaha

When Mississippi-born William Barney moved to Omaha, Nebraska, 24 years ago, he saw many of the problems he’d become familiar with as he traveled the country identifying strengths and struggles in African American communities.

Among the challenges, he said, were high levels of gun violence, low graduation and employment rates, and housing challenges.

He got to work, launching the African American Empowerment Network, a convener for those looking to solve issues that impact the Black community.

“We started by talking to a few people about things we could do together to improve conditions here,” Barney says, recalling conversations he had with pastors, residents and others.

Since then those talks have multiplied. Church visits and door-to-door chats became formal sit-downs with nonprofits, businesses, Omaha Public Schools, the police department, elected officials and many more, Barney says.

“We listen to each other, facilitate on collective tables, and develop plans to create change,” he adds.

Those talks have led to action, like a partnership between the school district and more than 40 organizations. Some 500 youth are now enrolled in Step-Up Omaha, a summer employment and training program for 14-to-21 year olds. And the Empowerment Network has worked to expand employment programs, foster civic engagement among youth and other residents, increase exposure to STEM fields and reach other diverse communities, including Latinx, Native American and Asian groups.

The outcome? Graduation rates rose and the unemployment rate plummeted, Barney said. Shootings are down with homicides dropping by 33% since 2011. And Omaha 360, an initiative of the Empowerment Network, is now recognized nationally as a model for violence prevention and intervention.

None of this work can be done in silos, he explains.

“No one individual, organization or business can solve these problems themselves,” Barney said. “We have shown that we can only create change by working together.”

The post 3 Cities That Became Better Places for Young Black Men appeared first on Reasons to be Cheerful.

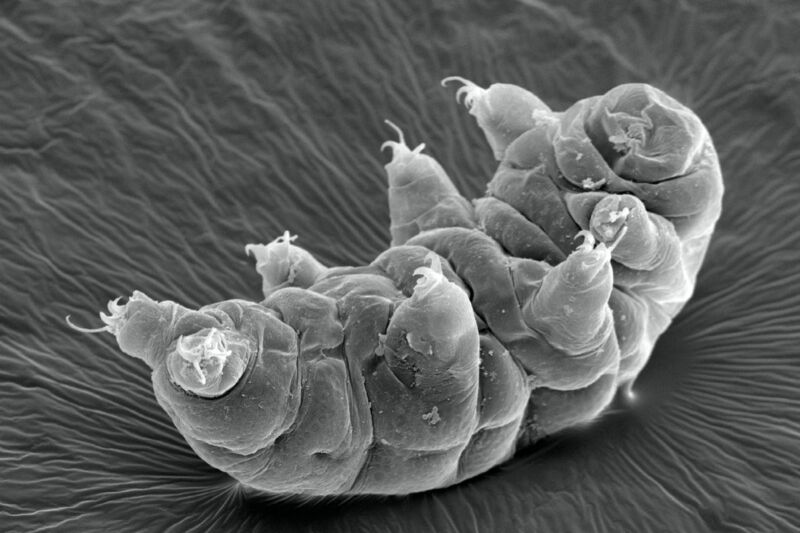

Enlarge / SEM Micrograph of a tardigrade, more commonly known as a "water bear" or "moss piglet." (credit: Cultura RM Exclusive/Gregory S. Paulson/Getty Images)

Since the 1960s, scientists have known that the tiny tardigrade can withstand very intense radiation blasts 1,000 times stronger than what most other animals could endure. According to a new paper published in the journal Current Biology, it's not that such ionizing radiation doesn't damage tardigrades' DNA; rather, the tardigrades are able to rapidly repair any such damage. The findings complement those of a separate study published in January that also explored tardigrades' response to radiation.

“These animals are mounting an incredible response to radiation, and that seems to be a secret to their extreme survival abilities,” said co-author Courtney Clark-Hachtel, who was a postdoc in Bob Goldstein's lab at the University of North Carolina at Chapel Hill, which has been conducting research into tardigrades for 25 years. “What we are learning about how tardigrades overcome radiation stress can lead to new ideas about how we might try to protect other animals and microorganisms from damaging radiation.”

As reported previously, tardigrades are micro-animals that can survive in the harshest conditions: extreme pressure, extreme temperature, radiation, dehydration, starvation—even exposure to the vacuum of outer space. The creatures were first described by German zoologist Johann Goeze in 1773. They were dubbed tardigrada ("slow steppers" or "slow walkers") four years later by Lazzaro Spallanzani, an Italian biologist. That's because tardigrades tend to lumber along like a bear. Since they can survive almost anywhere, they can be found in lots of places: deep-sea trenches, salt and freshwater sediments, tropical rain forests, the Antarctic, mud volcanoes, sand dunes, beaches, and lichen and moss. (Another name for them is "moss piglets.")

When their moist habitat dries up, however, tardigrades go into a state known as "tun"—a kind of suspended animation, which the animals can remain in for as long as 10 years. When water begins to flow again, water bears absorb it to rehydrate and return to life. They're not technically members of the extremophile class of organisms since they don't so much thrive in extreme conditions as endure; technically, they belong to the class of extremotolerant organisms. But their hardiness makes tardigrades a favorite research subject for scientists.

For instance, a 2017 study demonstrated that tardigrades use a special kind of disordered protein to literally suspend their cells in a glass-like matrix that prevents damage. The researchers dubbed this a "tardigrade-specific intrinsically disordered protein" (TDP). In other words, the cells become vitrified. The more TDP genes a tardigrade species has, the more quickly and efficiently it goes into the tun state.

In 2021, another team of Japanese scientists called this "vitrification" hypothesis into question, citing experimental data suggesting that the 2017 findings could be attributed to water retention of the proteins. The following year, researchers at the University of Tokyo identified the mechanism to explain how tardigrades can survive extreme dehydration: cytoplasmic-abundant heat soluble (CAHS) proteins that form a protective gel-like network of filaments to protect dried-out cells. When the tardigrade rehydrates, the filaments gradually recede, ensuring that the cell isn't stressed or damaged as it regains water.

When it comes to withstanding ionizing radiation, a 2016 study identified a DNA damage suppressor protein dubbed "Dsup" that seemed to shield tardigrade genes implanted into human cells from radiation damage. However, according to Clark-Hatchel et al., it still wasn't clear whether this kind of protective mechanism was sufficient to fully account for tardigrades' ability to withstand extreme radiation. Other species of tardigrade seem to lack Dsup proteins, yet still have the same high radiation tolerance, which suggests there could be other factors at play.

A team of French researchers at the French National Museum of Natural History in Paris ran a series of experiments in which they zapped water bear specimens with powerful gamma rays that would be lethal to humans. They published their results earlier this year in the journal eLife. The French team found that gamma rays did actually damage the tardigrade DNA, much like they would damage human cells. Since the tardigrades survived, this suggested the tardigrades were able to quickly repair the damaged DNA.

Further experiments with three different species (including one that lacks Dsup proteins) revealed the tardigrades were producing very high amounts of DNA repair proteins. They also found a similar uptick of proteins unique to tardigrades, most notably tardigrade DNA damage response protein 1 (TDR1), which seems to protect DNA from radiation. "We found that TDR1 protein interacts with DNA and forms aggregates at high concentration suggesting it may condensate DNA and act by preserving chromosome organization until DNA repair is accomplished," the authors wrote.

Clark-Hatchel et al. independently arrived at similar conclusions from their own experiments. Taken together, the two studies confirm that this extremely rapid up-regulation of many DNA repair genes in response to exposure to ionizing radiation should be sufficient to explain the creatures' impressive resistance to that radiation. It's possible that there is a "synergy between protective and repair mechanisms" when it comes to tardigrade tolerance of ionizing radiation.

That said, "Why tardigrades have evolved a strong IR tolerance is enigmatic given that it is unlikely that tardigrades were exposed to high doses of ionizing radiation in their evolutionary history," Clark-Hatchel et al. wrote. They thought there could be a link to the mechanisms that enable tardigrades to survive extreme dehydration, which can also result in damaged DNA. Revisiting data from desiccation experiments did not show nearly as strong an increase in DNA repair transcripts, but the authors suggest that the uptick could occur later in the process, upon rehydration—an intriguing topic for future research.

Current Biology, 2024. DOI: 10.1016/j.cub.2024.03.019 (About DOIs).

eLife, 2024. DOI: 10.7554/eLife.92621.1

04/17/2024 - Even if CO2 emissions were to be drastically cut down starting today, the world economy is already committed to an income reduction of 19 % until 2050 due to climate change, a new study published in “Nature” finds. These damages are six times larger than the mitigation costs needed to limit global warming to two degrees. Based on empirical data from more than 1,600 regions worldwide over the past 40 years, scientists at the Potsdam Institute for Climate Impact Research (PIK) assessed future impacts of changing climatic conditions on economic growth and their persistence.

“Strong income reductions are projected for the majority of regions, including North America and Europe, with South Asia and Africa being most strongly affected. These are caused by the impact of climate change on various aspects that are relevant for economic growth such as agricultural yields, labour productivity or infrastructure,” says PIK scientist and first author of the study Maximilian Kotz. Overall, global annual damages are estimated to be at 38 trillion dollars, with a likely range of 19-59 trillion Dollars in 2050. These damages mainly result from rising temperatures but also from changes in rainfall and temperature variability. Accounting for other weather extremes such as storms or wildfires could further raise them.

Huge economic costs also for the United States and European Union

“Our analysis shows that climate change will cause massive economic damages within the next 25 years in almost all countries around the world, also in highly-developed ones such as Germany, France and the United States,” says PIK scientist Leonie Wenz who led the study. ”These near-term damages are a result of our past emissions. We will need more adaptation efforts if we want to avoid at least some of them. And we have to cut down our emissions drastically and immediately – if not, economic losses will become even bigger in the second half of the century, amounting to up to 60% on global average by 2100. This clearly shows that protecting our climate is much cheaper than not doing so, and that is without even considering non-economic impacts such as loss of life or biodiversity.”

To date, global projections of economic damages caused by climate change typically focus on national impacts from average annual temperatures over long-time horizons. By including the latest empirical findings from climate impacts on economic growth in more than 1,600 subnational regions worldwide over the past 40 years and by focusing on the next 26 years, the researchers were able to project sub-national damages from temperature and rainfall changes in great detail across time and space all the while reducing the large uncertainties associated with long-term projections. The scientists combined empirical models with state-of-the-art climate simulations (CMIP-6). Importantly, they also assessed how persistently climate impacts have affected the economy in the past and took this into account as well.

Countries least responsible will suffer most

“Our study highlights the considerable inequity of climate impacts: We find damages almost everywhere, but countries in the tropics will suffer the most because they are already warmer. Further temperature increases will therefore be most harmful there. The countries least responsible for climate change, are predicted to suffer income loss that is 60% greater than the higher-income countries and 40% greater than higher-emission countries. They are also the ones with the least resources to adapt to its impacts. It is on us to decide: structural change towards a renewable energy system is needed for our security and will save us money. Staying on the path we are currently on, will lead to catastrophic consequences. The temperature of the planet can only be stabilized if we stop burning oil, gas and coal,” says Anders Levermann, Head of Research Department Complexity Science at the Potsdam Institute and co-author of the study.

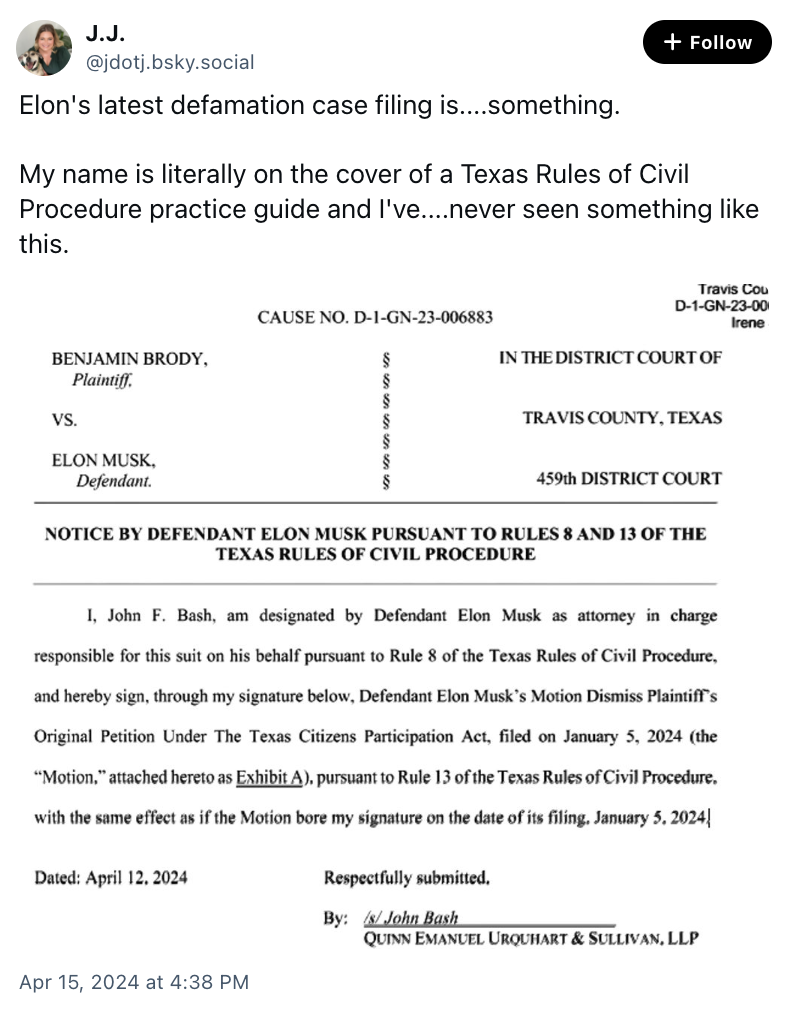

Elon Musk’s companies create robot cars (that unexpectedly blow up) and spaceships (that unexpectedly blow up), but now his attorneys are proposing a time machine to get out of — part of — a sanctions motion filed last week.

Elon Musk’s companies create robot cars (that unexpectedly blow up) and spaceships (that unexpectedly blow up), but now his attorneys are proposing a time machine to get out of — part of — a sanctions motion filed last week.

Feel free to guess what comes next.

Most of the coverage surrounding the sanctions motion (including Above the Law’s) focused on Musk’s disastrous deposition, defended by Quinn Emanuel’s Alex Spiro despite not being admitted in Texas — either outright or pro hac vice. Spiro, who told the New Yorker last year that his photographic memory is the source of his legal prowess, apparently failed to turn that memory toward the Texas rules as the transcript is littered with warnings from plaintiff Benjamin Brody’s attorney, Mark Bankston of Farrar & Ball, that Spiro kept breaching local rules.

But aside from the deposition, the sanctions motion also noted that Spiro is the sole signatory on the motion to dismiss the case without being admitted. That’s generally frowned upon as the unauthorized practice of law in most jurisdictions. It’s also a bizarre unforced error since Musk has local counsel in this case. Specifically, Quinn Emanuel’s John Bash, the former US Attorney who Rod Rosenstein notably ordered to push ahead with Trump’s child kidnapping plot who could’ve signed the motion way back in January and avoided this whole ethical kerfuffle.

But the past is the past… OR IS IT?

Bash, a Scalia and Kavanaugh clerk, takes the originalist penchant for rewriting history to new heights with this “Motion for a Mulligan,” asking the court to ignore Spiro’s signature and just assume Bash had signed it all along. On the one hand, you can argue that it’s Quinn Emanuel either way, so no harm no foul, right? On the other hand, it’s Quinn Emanuel either way so the firm should be held to an even higher standard since this is the most avoidable cock up ever.

Can Musk’s lawyers just wave their hands and pretend those past legal documents just don’t exist? Wait… it feels like we’ve done all this before. Remember Musk joking about buying Twitter and waiving due diligence and then trying to back out by saying the agreement he signed shouldn’t count?

How did that work out?

Earlier: Is Elon Musk About To Get Quinn Emanuel Sanctioned?

Joe Patrice is a senior editor at Above the Law and co-host of Thinking Like A Lawyer. Feel free to email any tips, questions, or comments. Follow him on Twitter if you’re interested in law, politics, and a healthy dose of college sports news. Joe also serves as a Managing Director at RPN Executive Search.

Joe Patrice is a senior editor at Above the Law and co-host of Thinking Like A Lawyer. Feel free to email any tips, questions, or comments. Follow him on Twitter if you’re interested in law, politics, and a healthy dose of college sports news. Joe also serves as a Managing Director at RPN Executive Search.

I was in San Antonio last weekend for a book festival, and took an early-morning run along the city’s River Walk. The paths go beside the water and below the streets, which cross the river on Art Deco bridges. A city looks different from underneath; you feel its layers of history.

Up at street level the book festival was underway, and in a tent filled with people I talked about Differ We Must, my biography of Lincoln as seen through his encounters with people who disagree with him. Moderator Dan Goodgame, editor of Texas Monthly, took the occasion to ask about an item in the news. NPR senior business editor Uri Berliner had written an article criticizing the people who work with him. His article alleged that his colleagues are unanimously progressive and publish progressive stories without any debate—a failure of “viewpoint diversity.” What did I make of that?

Having been asked, I answered: my colleague’s article was filled with errors and omissions. And having given my opinion in public, it’s fair that I should show my work in this space, where I often discuss NPR and journalism more broadly. Nothing I say here is personal; it’s about the journalism. I’ve already told Uri much of what I am telling you, and I have taken his responses seriously. He told me he loves NPR and wants to make it better.

If Uri wanted to start a discussion about journalism at NPR, he succeeded, though maybe not in the way he intended. His colleagues have had a rich dialogue about his mistakes. The errors do make NPR look bad, because it’s embarrassing that an NPR journalist would make so many. NPR correspondent Eyder Peralta wrote on Facebook, “There are a few bits of truth in this… but it mostly suffers from the same thing it accuses NPR of doing. It is myopic and uses a selective reading to serve the author’s world views.”

The errors are so numerous that his defenders—and he has some!—have taken to admitting them, then adding words to the effect of: I hope this doesn’t obscure his “larger point”!

If Uri’s “larger point” is that journalists should seek wider perspectives, and not just write stories that confirm their prior opinions, his article is useful as an example of what to avoid.

This article needed a better editor. I don’t know who, if anyone, edited Uri’s story, but they let him publish an article that discredited itself.

I discussed one example on stage in San Antonio. The article made headlines for Uri’s claim that he “looked at voter registration for our newsroom” in Washington, D.C., and found his “editorial” colleagues were unanimously registered Democrats—87 Democrats, 0 Republicans.

I am a prominent member of the newsroom in Washington. If Uri told the truth, then I could only be a registered Democrat. I held up a screenshot of my voter registration showing I am registered with “no party.” Some in the crowd gasped. Uri had misled them.

NPR says its content division has 662 people around the world, including far more than 87 in Washington. The article never disclosed this context. (NPR doesn’t ask employees about their voter registration; I don’t know how Uri learned the 87 registrations he says he found.)

When I asked Uri, he said he “couldn’t care less” that I am not a Democrat. He said the important thing was the “aggregate”—exactly what his 87-0 misrepresented by leaving out people like me. While it’s widely believed that most mainstream journalists are Democrats, I’ve had colleagues that I was pretty sure were conservative (I don’t ask), and I’ve learned just since Uri’s article that I am one of several NPR hosts of “no party” registration.

Is there a “larger point” that too many elite journalists share similar backgrounds, and think the same way in assigning and shaping stories? Yes, I think so, but it’s a subtle issue that has more to do with people’s educations, experiences and associations than with partisan registration. There’s less of a headline in that. And it’s an issue that NPR has tried to address with some of the people it has promoted, and by leaning more heavily on reports from our local stations across America.

A careful read of the article shows many sweeping statements for which the writer is unable to offer evidence. He says there is no debate over stories at NPR, just a “frictionless” process like an “assembly line.” I have been involved in passionate debates over stories at Morning Edition, as Uri knows; I have sometimes relied on his advice. Uri is a prominent editor—did he approve bad stories without friction?

Uri might have made a narrower statement, that certain specific stories are not tested, with too many easy assumptions. Or that we are too willing not to cover certain edgy stories. I might have agreed. But that would be a different story than Uri told.

When I challenged him, Uri seemed to acknowledge that there is debate, contrary to what he had written. But he said that is not important. He said the real test is what we broadcast or publish.

I agree: the test is what we broadcast. Yet the article keeps failing to nail down what bothers him about the broadcasts.

He writes of a dismaying experience with his managers: “I asked why we keep using that word that many Hispanics hate—Latinx.”

Why indeed? It’s true that many Latinos don’t like this ungendered term, including some who work at NPR. That may be why NPR does not generally use the term. I did a search at <a href="http://npr.org" rel="nofollow">npr.org</a> for the previous 90 days. I found:

197 uses of Latino

201 uses of Latina

And just nine uses of “Latinx,” usually by a guest on NPR who certainly has the right to say it.

Like Uri, I often have opinions about NPR’s coverage. Sometimes I am right; and sometimes I check the easily searchable archives and discover I am wrong. I wish he’d done the same.

My colleague goes on to write that “we” cover Israel through “the intersectional lens,” as progressives who see a battle of oppressors and oppressed.

First: who is “we”? I wasn’t aware that the senior business editor has covered Israel, but I have. He seems to have done no research before offering his assessment of my philosophy. Or anyone else’s. If he did explore his colleagues’ views on Israel, he would have found some “viewpoint diversity”!

But that’s beside the point. As Uri said, the test is what we report. His article does not critique a single NPR story on Israel.

Since he mentioned none, allow me. After the Oct. 7 attack, my first interview was with a member of the Israeli war cabinet. When I went to Israel my first story was on a Hamas missile attack; my second was on a Hezbollah attack; my third was on a hostage family. Later, I interviewed Prime Minister Benjamin Netanyahu. I have also interviewed many Palestinians and even a member of Hamas, covering all sides as a journalist should.

While in Israel, I saw my colleague Daniel Estrin in Tel Aviv and heard from my colleague Anas Baba in Gaza. Both have covered the story fairly, honorably, and at great personal cost. Scores of Americans, Israelis and Palestinians have contributed to the coverage.

If he was going to denounce these colleagues, Uri might at least have picked out specific stories that bothered him. Many of us could—I was in a discussion about such a story just a few days ago. But that would be a different story than he told.

The article does correctly note that in the fall of 2020, NPR did not repeat a New York Post scoop about the discovery of Hunter Biden’s laptop. The article leaves out the context: other organizations also held off on the story because of doubts about the laptop’s authenticity. It wasn’t confirmed until much later.

Above all, Uri calls for “viewpoint diversity” but did not seem to embrace it for this article. He didn’t seek comment from anyone or otherwise engage anyone who had a different point of view. The failure to vet the story may explain why the errors and omissions all go in one direction, toward confirming the writer’s pre-existing opinions.

A little vetting would have been good for the writer and his cause. This is especially true in the article’s lengthy attack on NPR’s diversity efforts.

If you conducted a confidential survey, you would hear a lot of “viewpoint diversity” within NPR about those efforts! And opinion would not break down entirely on racial lines. But Uri’s lengthy attack on those efforts had a particular effect on readers. One perceptive reader was Kenya Young of WNYC, a public radio station executive in New York. She is former senior manager at NPR, and widely respected. “The entire long diatribe,” she wrote on Facebook, “actually did not need to be included at all to make his points (some of which I believe to be valid), so the fact this it was shows me exactly where he’s coming from and (disappointingly) how he feels about the much needed changes that had to happen at NPR.”

Here is a prominent member of the community Uri says he wants to influence. He has her attention! And she is receptive to what he has to say! Then he loses his audience through an irrelevant “long diatribe.” The story is written in a way that is probably satisfying to the people who already believe it, and unpersuasive to anyone else—a mirror image of his critique of NPR.

If we separate that critique from its messenger, there are things to talk about, as Kenya Young says. We are broadcasting to a divided society, at a time when news media consumption has broadly declined. We are competing with many news organizations, and some of them make it part of their business model to tell their audiences not to trust NPR. It’s a tough crowd! And NPR can do more to rise to that challenge.

Many journalists describe the debate within their profession as not so much left vs. right as younger vs. older, or old-school journalism vs. a more activist position. Such debates can be good; but sometimes the traditionalists have fallen silent or struggled to find the language to hold up their end of the discussion. Uri was one who spoke openly, but ineffectively. He didn’t work any of the beats he complained about, which might be why his critique misfired so wildly.

My view is neither the old-school model nor the radical one. I don’t think we need new rules of journalism, but do need better execution of the rules we already have, as I have described in this Substack. We need to report and write more rigorously, and prove every point we make, conscious that someone out there will definitely not be on the same page. We need to be curious. We need to keep searching for new voices, and new facts. The whole of humanity is out there to be covered.